A more detailed version of this blog post has been featured on Monevator.com

Please note that this is by no means a recommendation that you take this approach. It’s a method I have chosen to donate money.

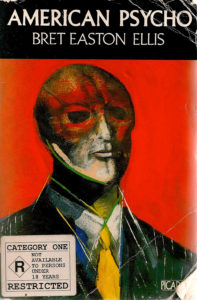

While reading a part of American Psycho by Brett Ellis I took a break due to how grim it is. During that break, I started looking into homeless statistics and came across the Crisis website which is a charity that directly helps homeless people find a home and also campaigns for changes needed to solve homelessness altogether.

After browsing through the site and learning more, I spotted the Crisis investor page which discusses Social Return on Investment (SROI). This is a completely new to me but my understanding of it is that by donating money you are making an investment in society that yields dividends and/or savings. They have conducted research and are able to provide estimates on the savings a donation makes. It boils down to – for each £1 you invest, there is around £3.30 SROI.

This return on investment comes from the result of helping people find homes and providing them with support they need which makes it more likely that they will start paying taxes.

Conceiving the machine

This got me thinking of stocks and shares investments in relation to charities and after some thinking the idea of a set of shares that are dedicated to perpetually creating money for charity came to mind and is something I found very appealing.

How do shares generate money?

When you buy shares you are buying a piece of a business. Some companies distribute money to shareholders in the form of something called ‘dividends’. Dividends are usually paid out periodically (usually a few times a year). Although not all companies give dividends, many do and the dividend payout can fluctuate (just like the stock price) .

Building the core of the machine

Getting this off the ground with the basics involved:

- Opening a low cost brokerage account (just for charity donations)

- Deposit cash in the account

- Purchase some shares (UK Vanguard ETF’s)

- Set dividends to pay out to bank immediately

- Bank transfer them over to the charity once they arrive

I’m currently on step 4 so I’m just waiting for some dividends to be paid at the moment.

Why make this ‘machine’

It perpetually generates money

So the key benefit is that in theory it should perpetually generate money. Share prices go up and down but British companies are pretty good at paying out dividends and by buying an ETF (an ETF is like buying a share of a group of companies. So if you bought a FTSE 100 ETF, you would be buying a slice of every company in the FTSE 100. For more on ETF’s please read this) you are not relying on a single company continually dishes out dividends.

You can build on it

This simply means adding more cash to it. So by periodically buying more shares, the dividend payout should on average increase meaning there is more cash to donate.

You have a lump sum

There is a lump sum in the account that you can call upon if things go really really bad and you need cash. However, lets stay positive and go with the plan of never needing to touch it and letting it continue generating the cash for donation.

It should grow by itself

In addition to this share prices have historically increased over time so we should find that this machine generates more cash as time goes on.

Automating the machine

What I have so far is a good starting point, it gets the ball rolling and it is now only a matter of time before some dividends are paid, ready to be donated.

However, the end goal is to completely automate this whole process so that in a sense it is a truly automated machine that regularly makes and dispenses money to charitable causes with little if any involvement from me. So it behaves just like a direct debit but instead of a set amount each month, dividends are checked are paid out as soon as they arrive.

More on this next time.